Small Business Restructuring (SBR) continues to be a key option for small businesses with outstanding tax debts and those facing a potential Director Penalty Notice – although the ATO’s attitude towards SBRs and payment plans appears to be changing. And Jirsch Sutherland has a clear message to directors: compliance history is critical.

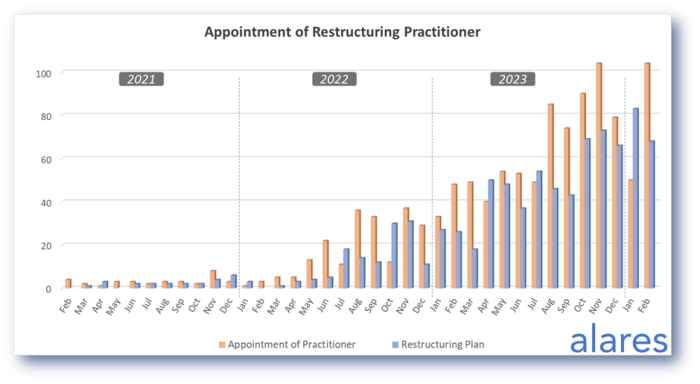

Since the regime was introduced in January 2021, there have been 1,153 restructuring practitioner appointments and 886 restructuring plans developed (to the end of February 2024). Of these, Jirsch Sutherland has (at time of writing) handled 66 SBR matters, with a success rate of 91%.

“It’s been interesting to see how Small Business Restructuring has evolved over the past three+ years,” says Chris Baskerville, Jirsch Sutherland Partner and SBR Practitioner. “In the first couple of years, the regime was so new and everyone was feeling their way, so SBR plans had a high success rate. As an example, in 2022, the ATO gave its tick of approval to 100% of the SBR plans handled by Jirsch Sutherland, while in 2023, 90% of plans were approved. It’s still a high success rate but we’ve certainly noticed a subtle shift in how the tax office views such plans. There’s now a more stringent process around the viability of a business. There’s no more “Lazarus rising from the ashes” using an SBR.”

| 2021 | 2022 | 2023 | 2024 (to 29 February) | |

| APPOINTMENT OF RESTRUCTURING PRACTITIONER | 34 | 207 | 758 | 154 |

| RESTRUCTURING PLAN | 24 | 132 | 559 | 151 |

Source: Alares

Patrick Schweizer, Director of Alares and author of Alares Insights, notes, “We continue to see a steady increase in the take-up of SBRs as the ATO maintains its vigilance in collecting legacy tax debts. The ATO is currently using all tools at its disposal including DPNs, Winding Up applications, personal bankruptcy petitions and the disclosure of outstanding business tax debts. For many small businesses, SBR remains a viable option for managing outstanding debts while ultimately also remaining in business.”

Compliance history vital

Baskerville says there’s a simple formula that if followed “ticks all the relevant boxes”. “It means you’re more likely to get a plan approved,” he adds. “Compliance history is critical. That has traditionally been the case with voluntary administration but now we’re seeing it more and more with SBRs. A lack of history can be a real red flag for the ATO.”

The three compliance areas where companies need to be up to date are:

1. Activity statements

2. Tax returns

3. Superannuation returns and payments

“Small Business Restructuring is certainly good for getting superannuation paid,” Baskerville observes. “Companies get up to date because they want to do an SBR.”

He adds, while many were sceptical about the regime at the start, “many are now viewing it very differently”. “It’s working well and creating better outcomes than if companies were simply wound up,” Baskerville says.

Jirsch Sutherland has launched a new Small Business Restructuring brochure, which outlines how the SBR process works, the benefits, and also provides a number of case studies across different industries, showing the myriad benefits compared to liquidation. To get a copy of the brochure head over to this link: https://www.jirschsutherland.com.au/brochure/JS_SBR_2024.pdf