Margins are being squeezed and insolvency numbers are rising as businesses seek solutions for the current challenging conditions.

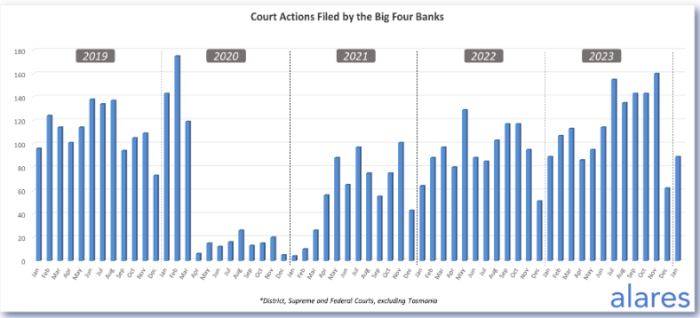

While government assistance during the pandemic slowed the number of insolvencies, it’s a different situation now. Insolvencies in January 2024 were 25 per cent above pre-COVID levels, according to figures from Alares Credit Risk Insights. Big-bank Court recoveries in the second half of 2023 increased dramatically, and with the challenging economic conditions continuing, there are concerns this trend will continue throughout 2024. Meanwhile, winding-up applications were slightly below historical levels but the overall trend is up.

One of the best ways to deal with the situation, according to Andrew Spring, Partner, Jirsch Sutherland, is for businesses to focus on their costs and profit to avoid margins being squeezed, which can lead to more problems. “Too many businesses are chasing sales instead of margins and robbing the future to pay for the past,” he says. “This isn’t an unusual approach, but we’re finding even experienced operators are now making this mistake.”

The current environment is challenging, and many business owners are feeling the pressure to maintain price points or to offer discounts to maintain top-line performance. The issue here is that the costs of business are increasing, which in turn suppresses profit margins. For businesses with limited working capital or legacy debt, this is a recipe for disaster.

“Margin squeeze is tricky to come back from,” Spring warns. “It can turn what was once a profitable business into an unprofitable one and this can seriously impact cash flow because that loss ends up being funded from working capital.”

He adds that’s why it’s important to understand your business’s costs and cash needs versus what the true performance looks like. “That knowledge helps owners to make good decisions and to avoid consequences such as poor cash-flow management, which can lead to business failure,” he says.

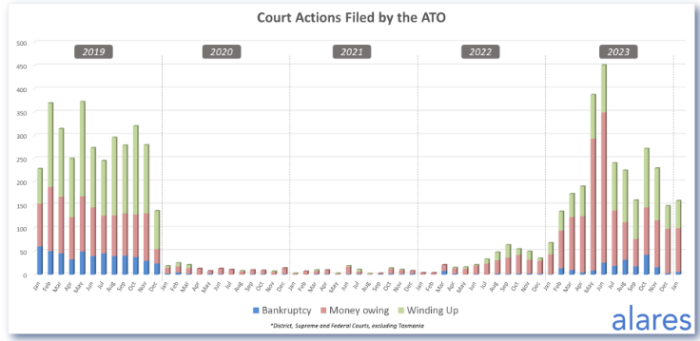

ATO continues to pursue debt

Another issue affecting businesses’ cash flow is tax debt. ATO tax debt remains higher than pre-COVID levels and the organisation is committed to collecting overdue amounts. Patrick Schweizer, Director with Alares, says this action could push many more businesses to the edge, especially as higher interest rates impact the serviceability of loans. “Outstanding tax obligations remain a challenge for businesses. Bank Court recoveries were well above historical levels in December and both ATO and non ATO-initiated winding-up applications continued apace.”

Schweizer adds January is historically a low month for insolvencies, so “it won’t be until February or March that we get a clearer idea about whether the trend from the end of 2023 continues into 2024”.

But Andrew Spring says that for Jirsch Sutherland, the year has started with a bang. “Usually, January is a quiet month but so far this year we’ve seen a high number of insolvency enquiries and appointments,” he says. “Since the pandemic, compassion have been front and centre for a lot of creditors when assessing financially distressed debtors. However, because the spike in insolvencies impacts creditors’ businesses, we anticipate seeing a more robust and active credit collection environment.”

SBR scheme offers help

One solution for struggling businesses is the use of the Small Business Restructuring scheme. ASIC figures identified 489 restructurings in the financial year to December 2023, which compares to 160 in the prior corresponding period.

While an SBR offers a number of benefits, one of the main ones is that directors retain control throughout the process of the day-to-day operations of the company. Creditors are supportive as they often receive a better return than if a company goes down the path of liquidation. It can also save jobs, deal with legacy debt, and re-establish workable and positive relationships with trade suppliers.

Meanwhile, Spring advises business owners to address any legacy debt positions as soon as possible by seeking independent expert advice. “Some holes are too deep to fill; you need someone to throw you a rope to help you climb out,” he says.