Tighter lending practices, rising interest rates, high inflation, supply chain and labour shortages. There’s now even greater pressure on businesses finding it increasingly difficult to stay afloat amid the lingering effects of the pandemic and the current economic challenges. That means the rebound in business insolvencies is intensifying – and Australia isn’t immune.

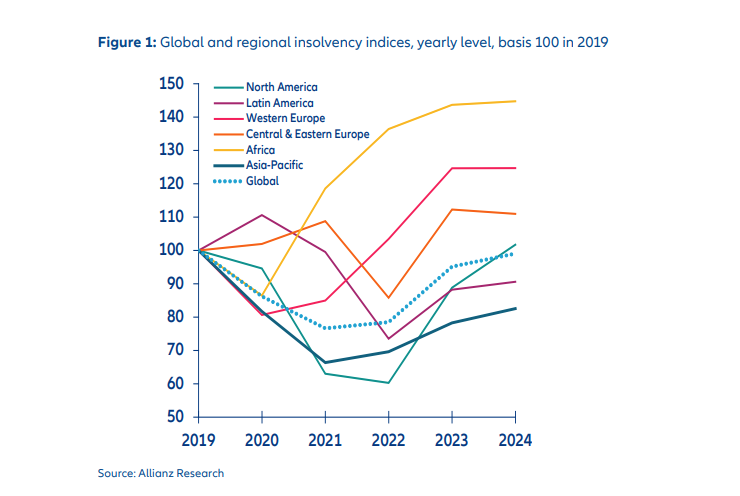

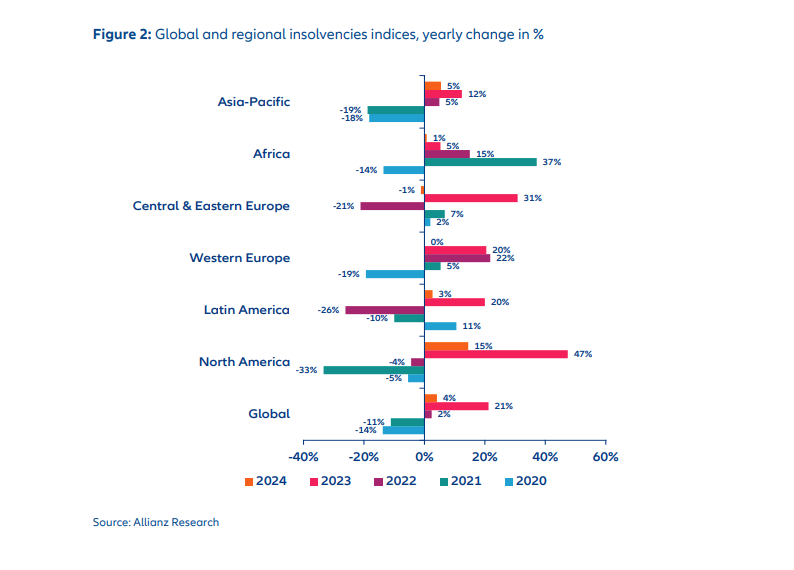

Financial services group Allianz sums the situation up succinctly in its latest insolvency report: “No rest for the leveraged.” It predicts its Global Insolvency Index will jump by +21% in 2023 and +4% in 2024.

“The rebound in business insolvencies is picking up speed,” states the Allianz report. “Beyond demand, prolonged pressure on profitability, weaker cash buffers and tighter-for-longer financial conditions are testing the resilience of most fragile companies. This includes those with the least pricing power (e.g., specialized retail such as textiles, household appliances, and some services including restaurants); those exposed the most to a higher wage bill such as retail, transportation and construction; and those most exposed to rising interest repayment costs (construction, durable goods). Cash is king but credit management practices have deteriorated according to the latest working capital requirements data.”

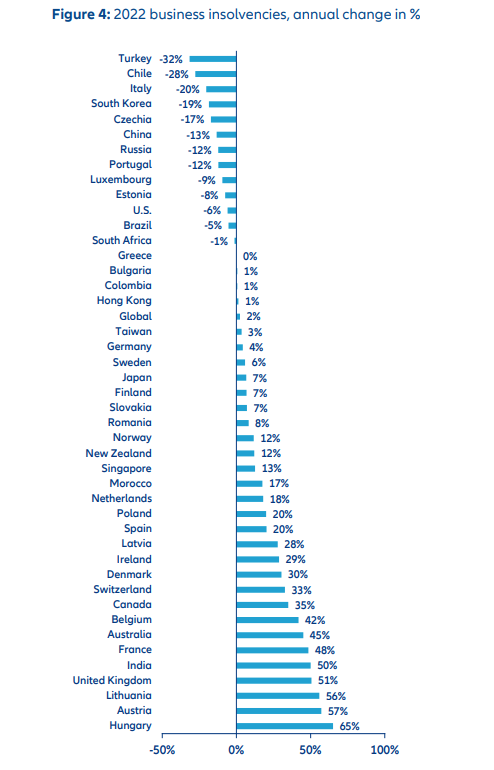

Three out of four countries Allianz analysed posted a rebound in insolvencies for FY2022; in Asia it was led by India (+50%) and Australia (+45%). Allianz expects more insolvencies in the region due to downside factors including elevated interest rates and inflation, with Australia predicted to see a 15% increase in insolvencies this year after the +45% rise in 2022.

“Elsewhere, as governments tighten spending, we expect a return to normal business conditions,” the report states. “This will put those companies that were already fragile before the pandemic and energy shock further at risk, alongside those that have not been able to adapt their business models to the structural changes created or intensified by the successive crises (“zombie firms”)”.

In a separate report into global insolvencies, trade credit insurer Atradius predicts that the global insolvency landscape will be more mixed in 2024, with some countries witnessing a rise in insolvencies while others start to see a decline or stabilisation, as companies that aren’t able to survive without government support (i.e., zombies) will have already been wound up.

“The coming years are likely to remain challenging for firms,” says Theo Smid, senior economist with Atradius. “[They] face an environment with significantly tighter financing conditions, which is likely to be a challenge for firms that have taken up a lot of debt during the pandemic.”

On the local front: calm before the storm?

The latest Alares Credit Risk Insights report shows that in April, typically a slow month, Australian insolvencies continued to track above pre-covid levels as the ATO continues to ramp up its Court recoveries. The major lenders also had a relatively slow month in April ahead of their typical busy season in May and June.

The total number of ATO initiated Court actions continues to increase towards historical levels, while winding-up applications in April were relatively low, although as Alares points out, this isn’t unusual, as May and June have historically dominated the Q2 numbers. It’s a similar story for the Big Four banks, which also had a relatively quiet month in April. Court recoveries from the big banks have historically peaked in the middle of the year. “All eyes will be on the May and June numbers to see if this trend continues,” the Alares report states.

At a non-Big Four level, money lenders took a momentary breather last month, which is again in line with the trend from prior years, adds Alares.

At Jirsch Sutherland, we are receiving more enquiries and handling an increasing number of matters across many industries. In line with recent ASIC data on external administrations, these include accommodation and food services, construction and retail, among others.

So, while April was quieter, it’s a good reminder for directors and accountants to do a business ‘health check’ before end of financial year – and if there are any financial challenges, please don’t hesitate to reach out. The sooner you hop onto it, the more options there may be to get your business – and life – back on track.

Michael Chan

Principal- Jirsch Sutherland