Personal insolvencies are forecast to rise to pre-COVID levels over the next two years as cost-of-living pressures and economic uncertainty start to have an effect.

In its latest report, the Australian Financial Security Authority (AFSA) found 9545 personal insolvencies were recorded in the 2021-22 financial year – a figure well below half the 10-year annual average of 25,300. However, it says this situation is expected to change, due to financial pressures and the various stimulus packages available throughout the pandemic no longer being available.

Jirsch Sutherland Principal and personal insolvency specialist, Michael Chan, says an insolvency cliff could be coming up as the official cash rate continues to rise, the cost of living keeps increasing, and wages fail to keep pace with inflation.

A perfect storm

“The perfect storm is brewing,” he says. “When rising interest rates are coupled with inflationary pressures, past trends have shown a corresponding rise in bankruptcies.” [The RBA lifted the cash rate for the ninth consecutive month in February to 3.35% – the highest level in just over a decade. Meanwhile, in January, the Australian Bureau of Statistics found inflation rose by 7.8% over the 12 months to December 2022, the fastest rate since March 1990. ]

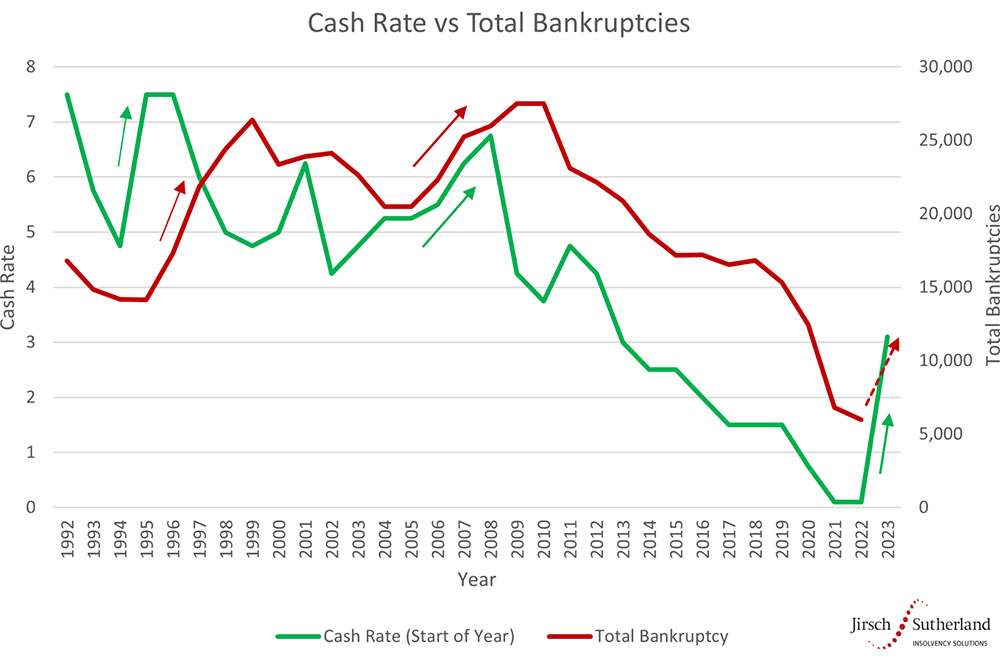

Chan says the current situation correlates to the sharp economic slowdown that occurred in the mid-90s (following the 1991 recession). During this time, the cash rate and bankruptcies rose simultaneously. They were also almost in lockstep during the 2007-08 global financial crisis, and it’s a similar situation now, he says.

During the GFC for example, Chan says many used the equity in their homes to buy investment properties. “When interest rates spiked, they found the rental income wasn’t enough to cover their mortgages,” he says. “That resulted in bankruptcy numbers rising sharply. The situation now is that there are many properties bought over the past two years that have a good amount of equity in them and people still have savings to potentially stave off any ongoing issues.”

However, he adds, while bankruptcy numbers remain stable and homeowners still have some savings, cracks are appearing. “Staff cuts and recession warnings are more prevalent, the tax man is in debt recovery mode, and regulators are getting ready,” he says. “We’re already seeing a definite increase in corporate insolvencies and believe personal insolvencies will follow.”

Jirsch Sutherland produced a graph that shows how bankruptcies will sharply rise if the current situation mirrors past economic slowdowns.

If rates approach 4 per cent, the graph suggests personal insolvencies could triple to 15,000 this year, a view Chan believes is possible based on historical numbers.

Financial health check urged

Meanwhile, the AFSA figures show most people who entered into personal insolvency during 2021-22 had low levels of debt: 52.7% of insolvencies in the past financial year involved less than $50,000 in liabilities. Just over a quarter of insolvencies had debts totalling more than $100,000.

Chan says consumers and business owners should carry out a financial health check to help determine their position. If they find any issues, he urges early help is sought.

“Financial distress can take people by surprise,” he says. “The cost of living is increasing so quickly that even if someone is employed, it doesn’t mean they can service their debts. Other pressures, such as the falling house prices, may also put homeowners into a negative equity position, not to mention people falling off the ‘fixed-rate cliff’ when they revert to sharply higher variable rates.”

There are options available for those experiencing financial stress. These include informal payment arrangements, debt agreements, personal insolvency agreements and bankruptcy.

“What we do not recommend, is ignoring the problem and hoping it goes way,” says Chan.