The latest insolvency statistics from ASIC show the number of insolvencies continues to rise, as poor economic conditions and the ATO’s aggressive debt-collection action kick in. In the 2023 financial year, corporate insolvency appointments were 7,942 compared to 4,912 for the previous financial year, an increase of more than 60%. The sectors most affected are Construction (representing more than 10% of all appointments), Accommodation and Food Services (5%), and Retail (about 3%).

At Jirsch Sutherland, our corporate appointments are in line with those highlighted by ASIC as the hardest hit. For example, 21% of our appointments in the last financial year were linked to Construction, 15% to Accommodation and Food Services, Other constituted 11%, while Retail Trade comprised 8%.

However, another sector experiencing pain is Transport, which has been severely affected by skyrocketing insurance, fuel and repair costs. Many transport-related companies have collapsed in the wake of this environment, and we believe more are on the horizon.

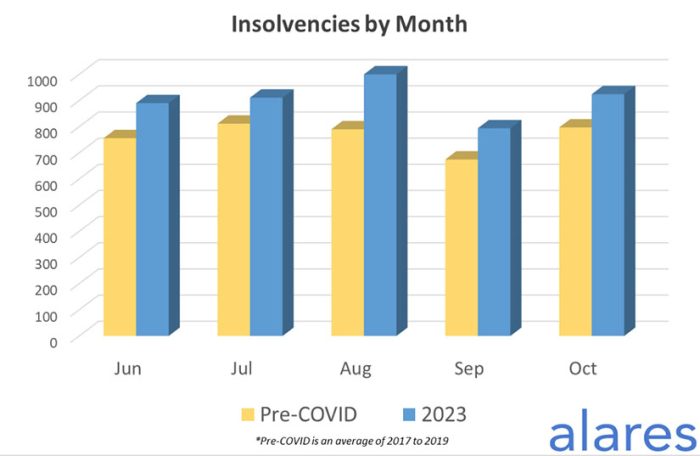

The graph below, from Alares, shows how insolvencies are rising in the current period compared to the pre- COVID period.

The situation of rising insolvencies is exacerbated by the current economic environment, particularly interest rate rises, wage costs, material cost increases and local and global disruptions. All are feeding into the current pressures felt by businesses. However, an additional cause comes from the ATO and its heightened focus on recovering the money it’s owed.

This has become more apparent over the past few months. In this time, the ATO has been taking a more active role in Small Business Restructuring plans. While previously it readily agreed to these types of plans – as the regime was quite new, having only been introduced in January 2021 – now it is becoming more involved to ensure they provide a proper return. The ATO’s involvement is coming through the specialist teams it has built in this time and through requiring more information from affected businesses. The ATO is usually the controlling creditor and now wants companies to explain in greater detail their liabilities, the circumstances that have caused the financial stress they’re in and why the proposed outcome will be a better one for creditors.

Risks to directors

One issue we continue to highlight to clients is the importance of understanding that even if a company is wound-up, directors can face risks, including being personally liable for any debts. The ATO is aggressively taking action to recover debt under the Director Penalty Notice regime: since late 2022 and into the first half of this year, it has been issuing up to 100 DPNs a day. We recently had a former company director linked to a creditors’ voluntary liquidation, which was finalised in 2019, advise that the ATO had issued them with a DPN linked to a superannuation guarantee charged for quarters covering the 2015 and 2016 years. This is a sign that the ATO is dusting off old files and looking at recovering company debt from directors personally where they have the power to do so under the DPN regime.

Patrick Schweizer, Director of Alares, says many of the current ATO Court actions appear to involve legacy tax debts of companies and individuals who were subject to ATO Court actions in 2019. “The data clearly points to the ATO pushing to clean up and collect legacy debts, which may also explain the recent spike in Small Business Restructuring appointments, as business owners look for ways to keep their businesses afloat,” he says. “In previous months, the increase in SBRs coincided with a drop in ATO Court activity; however, October saw an increase in both restructuring and ATO activity.”

The latest Alares Credit Insights Report shows winding-up applications have been on the rise since early 2022 and at Jirsch Sutherland we stress that directors should act now if they have a tax debt, even if the debt is years old and relates to businesses that have been wound up.

Meanwhile, our research indicates external administration numbers will continue to rise and likely reach 8,550 for the 2024 financial year, a significant increase on 2023. With no end in sight regarding the poor economic conditions, and with the ATO ramping up its recovery action, struggling businesses cannot afford to take a head-in-the-sand approach to their situation.

If your business, or you as an individual, are financially distressed, seek advice now rather than later. The longer you leave it, the fewer options are available. Please don’t hesitate to reach out to myself or any of my colleagues if you need assistance.

Tina Battye

Principal

Jirsch Sutherland

Insolvency warning signsIt’s important to recognise when financial challenges may lead to a potential insolvency. There are some common warning signs, such as poor cash flow or rapid increases in debt, which are included in the graphic below. If you recognise any as applying to your business, obtain advice now rather than later, as the earlier you seek help, the more solutions are available to help save or restructure your business.

|