There’s no denying it: the ATO is serious about collecting monies owed to it. And small businesses – including sole traders – are at the top of the hit list, because they’re responsible for the biggest tax gap due to the pandemic. It’s estimated small businesses currently owe around $30 billion in tax debt.

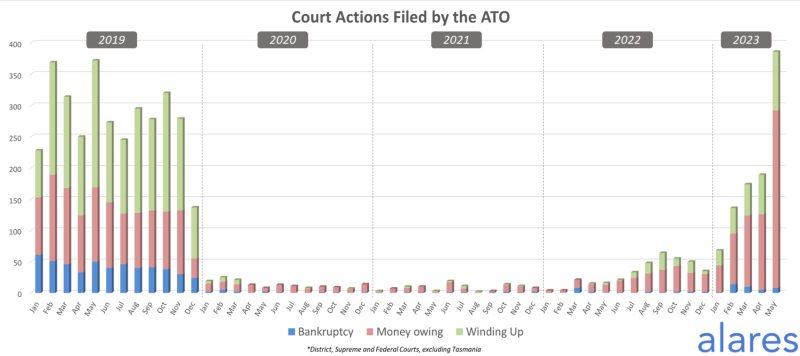

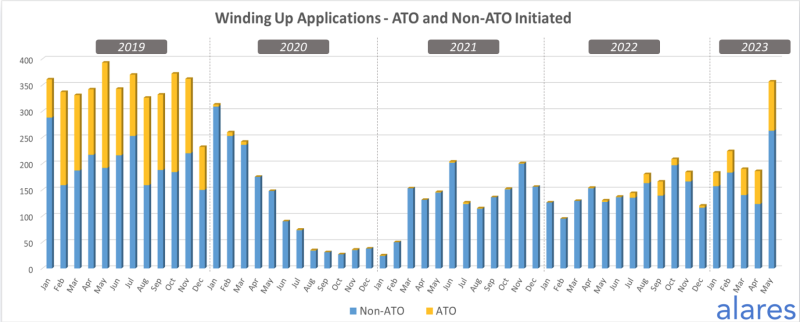

It’s been interesting to track the timeline of the ATO’s debt recovery since the pandemic was declared. During the darkest COVID times, the tax office temporarily paused tax collection to assist struggling SMEs, and in March 2020, its wind-up applications plunged to their lowest level since 2014. But in early 2022 the ATO finally ‘took off the velvet gloves’. In May last year the ATO said it was on a “firmer footing” for compliance activities, and there were reports that DPNs were being issued at the rate of 30-40 a day, quickly jumping to around 120 a day as insolvencies hit pre-pandemic levels. It also started to issue garnishee notices. Fast forward to May this year and there was a major uptick in ATO Court activity, surpassing historical monthly totals, with winding up applications also on the rise, according to the May credit risk insights by Alares.

Six-month amnesty

But despite the tougher rhetoric and actions, the ATO has still given small businesses a window of opportunity to get their lodgements up to date. Announced in this year’s Federal Budget, an amnesty was put in place for small businesses (turnover less than $10M) that have failed to lodge income tax returns, fringe benefits tax returns or business activity statements.

Amnesties are a tool used by the ATO in circumstances where it believes there is a significant number of non-compliant taxpayers. The last one was for superannuation guarantee payments, where employers were given a chance to make good any past underpayments. It resulted in more than $910 million of underpayments.

This current amnesty applies to tax obligations that were originally due between 1 December 2019 and 28 February 2022, and it runs from 1 June 2023 to 31 December 2023.

Emma Tobias, ATO assistant commissioner, has urged small businesses to take advantage of the amnesty to get back on track with their tax obligations if they’ve fallen behind. “The past few years have been tough for many small businesses, with the pandemic and natural disasters having a significant impact,” Ms Tobias says. “We understand that things like lodging ATO forms may have slipped down the list of priorities, but it is important to get back on track with tax obligations.”

When lodgements are made to the ATO under the amnesty, businesses or their tax professionals will not need to separately request a remission of the failure-to-lodge penalties. The amnesty does not apply to superannuation obligations and excludes other administrative penalties, including General Interest Charges. There is also the potential for personal liability under the Director Penalty regime, which automatically makes directors personally responsible for the unpaid debts of a company for PAYG, GST and the Superannuation Guarantee Charge (SGC) where lodgements occur three months or more after the due date.

For businesses that have failed to lodge because they’ve ceased trading, they need to advise their registered tax professional, or notify the ATO directly.

It’s good to see the ATO is still taking a ‘considered’ approach with small businesses, particularly because of the tough times they have experienced and continue to experience. But it’s still not a time for complacency. Insolvencies are on the rise amid the current challenging economic conditions.

We have seen a big increase in the number of small businesses taking advantage of the Small Business Restructuring process to get their businesses back on track and clear legacy debt (particularly tax debt). The ATO has given SBRs an unofficial ‘tick of approval’ and it’s certainly been a good solution for eligible business across myriad industries.

My fellow Small Business Restructuring Practitioners are here to help if you have found yourself in financial stress and with a sizeable tax debt. Please don’t hesitate to reach out for an obligation free consultation to determine whether an SBR or other solution is best suited to your business’s individual needs.

Andrew Spring

Partner

Jirsch Sutherland