Highly leveraged businesses at most risk

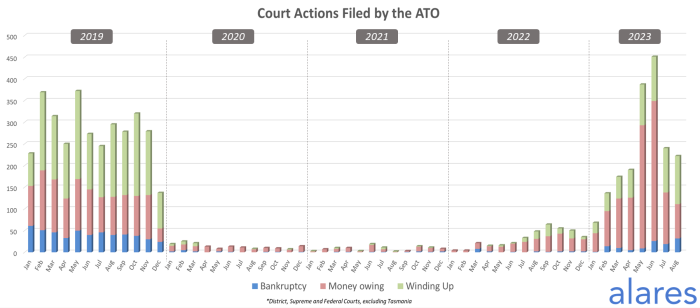

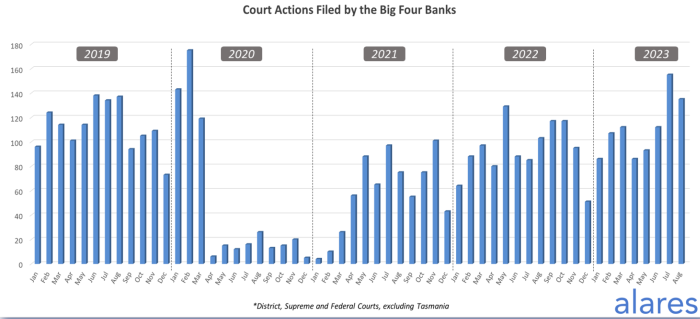

The ATO crackdown on businesses that have a tax debt continues apace, with ATO Court activity now back in line with historical levels. It’s not just the taxman that directors need to be wary of; the big four banks are also active in their Court recoveries as borrowers continue to face pressure from higher rates. And as creditors increasingly ‘come knocking’, highly leveraged businesses could be at most risk.

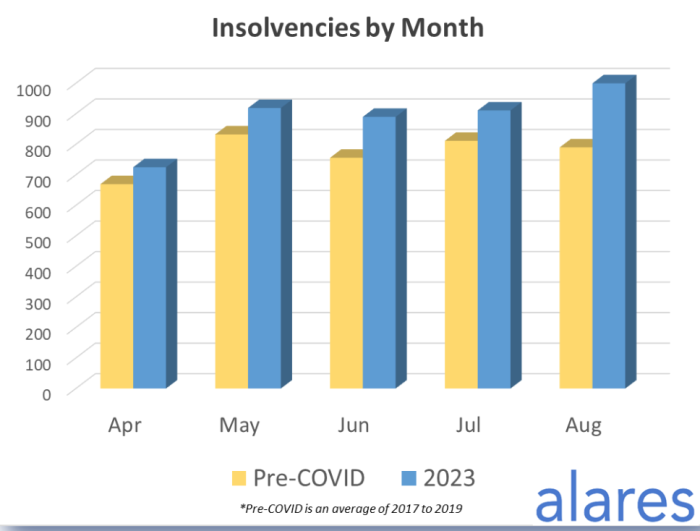

The latest Alares Credit Risk Insights report shows the combined economic pressures and Court activities by the ATO and other entities is having a significant impact. August recorded the highest monthly insolvencies so far in 2023, which was well above pre-COVID monthly totals. While the ATO remained active in the Courts, activity in August was off the sharp peak recorded in May-June.

“Overall numbers naturally fluctuate from month to month, but it’s clear insolvencies are back to historical levels after the COVID lull,” says Alares Director and report author Patrick Schweizer. “The key driver for this is the ATO. During COVID, businesses were effectively encouraged to defer or ignore their tax liabilities and this, for many, was combined with large stimulus payments.

“The holiday has been over for a while now and the ATO is very much in collection mode, which is taking many forms, such as Director Penalty Notices (DPNs), Court claims, winding up applications against companies, and sequestrations against individuals. Many of the ATO’s current bankruptcy and winding up applications had prior ATO money owing claims filed in 2019, which indicates that the ATO is playing catch up on old debts and is doing so aggressively.”

ATO focuses on changing mindsets

Collectable tax debt has soared by 89 per cent in the past four years, with many businesses getting into the habit of putting off paying the tax they had owed since the pandemic. At a recent Tax Institute Summit, ATO Deputy Commissioner Vivek Chaudhary told the audience that “for a lot of businesses this was the right thing to do, and it delivered many successes”.

“But it also had an impact on payment culture, and we are seeing more businesses not paying tax on time since before the pandemic began,” he said.

“As a consequence of our more lenient approach during the pandemic, we have seen an increased expectation that interest and penalties will be remitted. Businesses appear to be de-prioritising payment of tax and super when they should be provisioning for these bills like they would with any other business expenses. This is a trend we need to turn around.”

Currently $23 billion in unpaid activity statement debt is owed by small business, and the ATO is working on addressing this behaviour. Mr Chaudary said it was taking firmer action against those paying late or not at all, including legal action against those with large debts and especially those who are choosing not to engage.

“This more aggressive stance by the ATO coincides with a challenging landscape for many businesses with higher borrowing costs, as well as supply chain constraints and input cost increases,” says Schweizer. “We are already seeing the big four banks increase their total number of Court filings. Highly leveraged businesses that are unable to pass increased costs onto their customers will clearly be at most risk.”

The latest Alares Credit Risk Insights report shows the big four banks also remained active in August after a busy month in July.

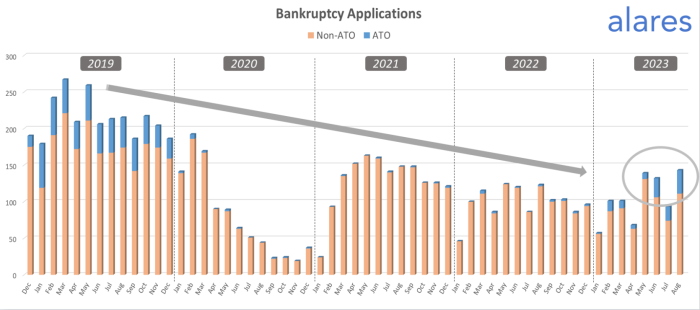

It’s not just businesses that are in the ATO’s crosshairs. Over the past few months, creditor-initiated bankruptcy applications have been rising, after generally trending downwards for many years, the Alares report shows. “These are the first signs this trend may be changing,” says Schweizer. “It also coincides with a recent increase in ATO-initiated bankruptcy filings.”

Jirsch Sutherland Partner Malcolm Howell says these “shots over the bow” of both individuals and businesses are clear signs that the ATO and other creditors mean business. “Many were lulled into a false sense of security during the COVID stimulus years, but that’s no excuse now to put your head in the sand and hope they go away,” he says. “The sooner you seek help, the greater the solutions that might be available to address your business or personal financial challenges.”