The heat continues to be ratcheted up on illegal phoenix transactions – and it was certainly the hot topic at Jirsch Sutherland’s seminar on Thursday September 7, with special guest Professor Helen Anderson, head of the Phoenix Research Team, regaling guests with the enormous cost of illegal phoenixing on the Australian economy – believed to be anywhere between $1.9 and $3.2 billion every year – and how the problem could be tackled.

Professor Anderson covered a lot of ground in the seminar “Phoenix activity: what’s legal and what isn’t, and what do liquidators need to help them”. One of the main topics was around the need for mandatory Director Identification Numbers (DIN), which Professor Anderson and her colleagues had recommended to the Federal Government as one solution, and greater transparency around the history of company directors.

Professor Anderson covered a lot of ground in the seminar “Phoenix activity: what’s legal and what isn’t, and what do liquidators need to help them”. One of the main topics was around the need for mandatory Director Identification Numbers (DIN), which Professor Anderson and her colleagues had recommended to the Federal Government as one solution, and greater transparency around the history of company directors.

In welcome news, just days later the Government announced a crackdown, whereby each Australian company director will be assigned a unique identification number under tough new laws designed to prevent them deliberately scuttling their companies to avoid paying creditors and then starting up businesses without those debts.

“This is a step in the right direction,” says Jirsch Sutherland Partner Andrew Spring. “By making people more aware that they can be easily tracked, it may act as a deterrent to engaging in illegal phoenix activity. And with mandatory DINs, which will require proof of identity, it may stifle the incidence of straw or ‘dummy’ directors. My fellow Partners and I have seen a number of incidents of homeless or other vulnerable people named as directors of newly-formed companies. Any steps taken to eliminate this practice, designed simply to conceal the true parties in control, receives our support”.

ASIC has identified 11,500 potential phoenix operations, and the ATO has told a Senate inquiry that as many as 20,000 companies may be building their wealth through “illegal phoenix behaviours.”

The Directors Identification Number will enable directors to be tracked through other government agencies and databases in order to map their relationships to other companies and other people.

In addition to the DIN, the Financial Services and Revenue Minister Kelly O’Dwyer announced that the government will consult on the implementation of a number of other measures designed to discourage or interrupt illegal phoenix operators.

Some of the measures identified include:

– Extending the ATO’s Director’s Penalty Notice to establish director personal liability for GST debts

– Allowing the ATO to be able to commence immediate recovery action following the issuance of a Director Penalty Notice

– Stronger powers for the ATO to recover security deposits

– Preventing directors from backdating resignations or from resigning where it leaves a company with no directors

– Prohibiting related entities from appointing a liquidator to companies whose directors have a history of phoenix activity

“Of course it must be remembered that the survival of a business through an appropriately managed transaction, at full value, is legal. If considering such a transaction, directors should seek expert advice from a registered insolvency professional,” says Andrew.

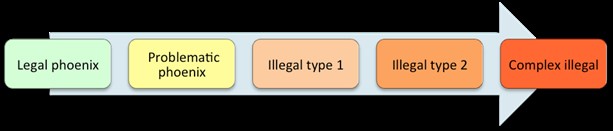

There are five types of phoenixes:

1. Proper business rescue, full price paid for assets

2. Another collapse caused by someone who should not be in business

3. Company intended to succeed but advised to phoenix to shed debts – full price not paid

4. Company intended to fail from the start 5. Illegality a way of life – e.g. GST fraud, visa fraud etc.

Source: The University of Melbourne; Professor Helen Anderson