Debt deferral initiatives designed to keep Australian businesses afloat during the COVID-19 crisis will do little more than postpone an inevitable avalanche of business closures, according to many working at the coalface.

While government stimulus packages will enable many at-risk operations to stay afloat during the next six months, the inevitable payback requirements resulting from deferred rent, loan repayments and utility bills will likely force many into extinction.

“Imagine having to pay six months’ rent, utilities and financing costs as a lump sum when the coronavirus emergency finally ends,” says Jirsch Sutherland Partner Sule Arnautovic. “That’s the situation many businesses will be facing, and most won’t be able to survive that type of capital hit.”

CommSec economists have identified a plethora of Australian industries most at risk due to the COVID-19 crisis, including forestry and logging, coal mining, oil and gas extraction, and food product manufacturing. Air transport, tertiary education and residential care are also set to suffer significantly.

“Around 25 per cent of the economy will be hit very hard, with many businesses being shut down temporarily,” explains CommSec Senior Economist Ryan Felsman.

“But some may not recover due to government COVID-19 enforced restrictions pressuring cash flows, while rising unemployment will impact consumer demand for goods and services. These lockdowns are also going to have a big impact on the services sector in particular, with accommodation and food services, recreation and personal services, retail trade, international education, the aviation and the real estate industries all hit hard by social distancing measures.”

Felsman adds that to date there’s been some laying off of staff and temporary furloughing by companies in at-risk industries as they struggle for survival or hibernate.

“Casual and part-time workers are particularly vulnerable,” he says, adding the enormous economic damage being wrought by COVID-19 will lead to a prolonged period of challenge and adjustment.

“We’re now in the first recession since the early 1990s and the consumer situation will be very weak going forward,” he says. “The IMF [International Monetary Fund] is even forecasting the biggest economic downturn since the Great Depression.”

CommSec expects the Australian economy to contract by 7.5 per cent in the June quarter and by 3.4 per cent for 2020, before an expected recovery after the pandemic subsides in 2021.

While government stimulus packages have been touted as a crucial lifeboat for a broad section of the economy, the future for many businesses still appears dire – even for those who receive help in time.

“Unless some government stimulus comes through to us very soon, we will only be able to survive another four weeks,” says one beleaguered Sydney restaurant owner. “But even if we get that money and somehow make it through to the end of the crisis, what then? The fact that we’ll have to pay back a bunch of outstanding bills will mean we still won’t be able to cope.”

Time to act

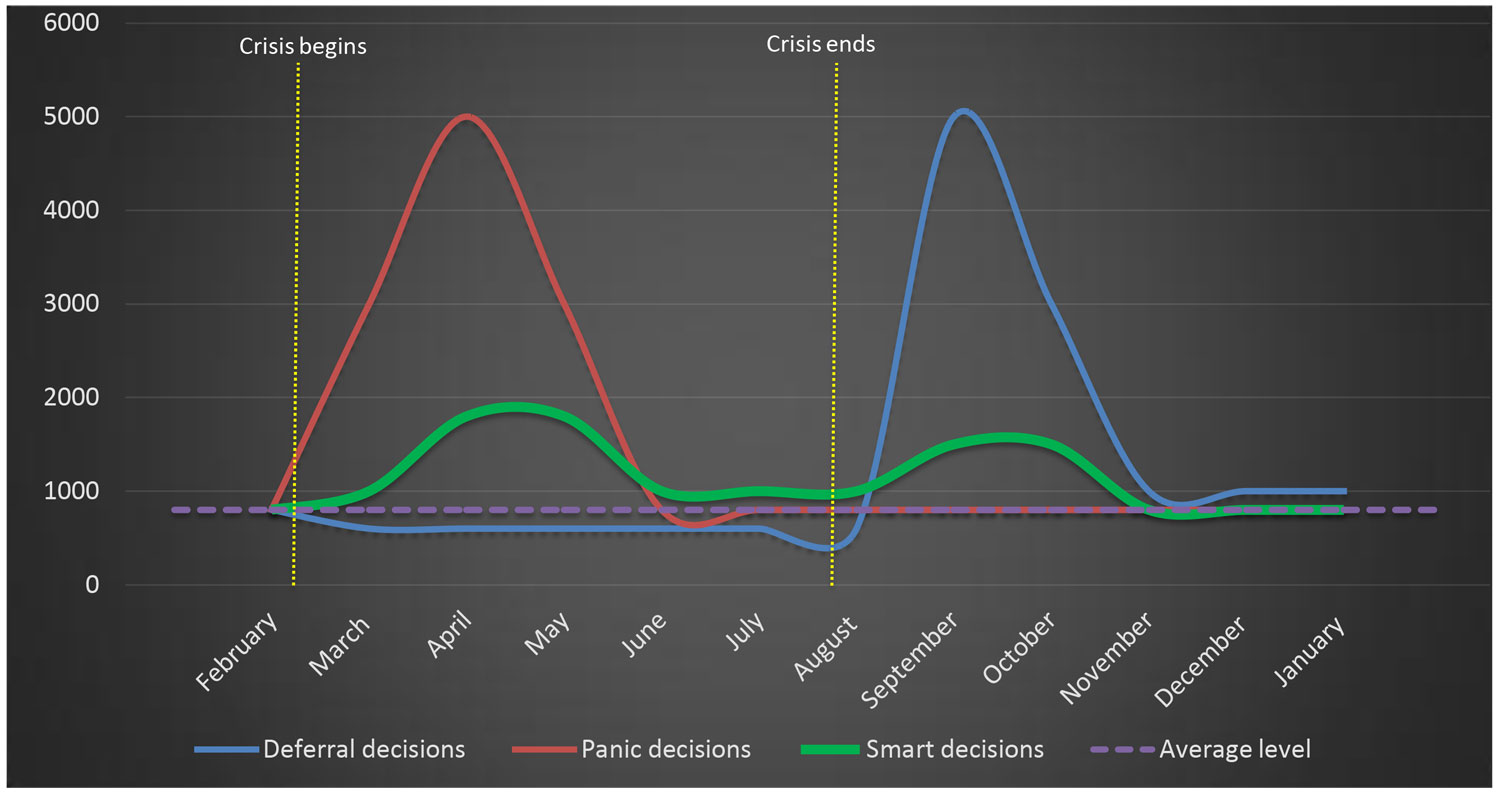

With mass insolvencies predicted once the recovery period commences – that is, when the stimulus support ends – experts warn that now is the time to act, particularly for businesses that were struggling even before the current crisis emerged.

“Debt deferral with no exit strategy is fatal,” warns Arnautovic. “Unless appropriate action is taken now, it’s highly likely that in six months’ time we’ll see a proliferation of businesses failing completely or experiencing dire financial difficulties. Indeed, during the global financial crisis, the busiest insolvency period occurred some 12-18 months after the initial shock, when banks began to enforce repayment requirements and the taxation bodies started ‘knocking’ on doors for deferred tax.”

Arnautovic says that while the regulatory and ethical obligations of directors have never been greater, neither have the consequences for individuals who get it wrong.

“Deliberately avoiding debt can land directors in even hotter water,” he says. “The recent government moratorium on insolvent trading is somewhat of a red herring, given the raft of director obligations stipulated in Australia’s corporate legislation.”

While the current prognosis for many businesses is dire, Arnautovic says there is a range of available measures that can help them ride out the crisis and re-commence their activities once the coronavirus crisis is over.

Opting to restructure a business early (utilising the framework established under the Safe Harbour legislation) is one possible course of action, as is initiating a merger or consolidation. Creating a creditors’ trust (a legal arrangement used to accelerate a company’s exit from external administration) for participating creditors may also be advisable.

“Owners may alternatively choose to implement ‘holding’, ‘hibernation’ or other Deeds of Company Arrangements (DOCAs) with a view to extending the period of moratoriums,” explains Arnautovic. “This will buy crucial time to investigate potential restructuring opportunities. Immediate liquidation and loss minimisation is also an option. This will possibly allow a business to restart further down the track.”

For business owners or directors who believe they may have prospects on the other side of the pandemic, Arnautovic says seeking immediate professional advice with a view to taking advantage of formal insolvency or restructuring options is vital.

“Action taken now dramatically increases the likelihood that stressed businesses will be able to re-emerge – albeit with different operational models or strategies – once the coronavirus crisis abates and the expected upturn commences.”

Why company directors and accountants/lawyers should not delay insolvency/restructuring appointments:

|