WAIS Partner David Hurt has had a long and storied career spanning 40 years in the insolvency sector. From mining, retail, contracting and food services to civil engineering, aquaculture and manufacturing, David has seen it all.

After joining national accounting practice Hungerfords as a graduate in 1976, David was placed in the Insolvency division. After a few acquisitions and mergers, he left in 1991 to join a mid-sized firm in West Perth.

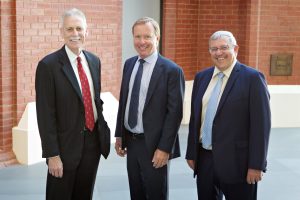

“That relationship came to an end and in 1998 I joined a national accounting practice as a senior manager where my fellow WAIS colleagues, Kim Strickland and Chris Williamson, were Partners,” he recalls.

A few years later when the firm broke up and the Insolvency division joined Sims Partners, the trio continued working together before Kim and Chris decided to forge a new path and establish WAIS – WA Insolvency Solutions – in 2008.

“Next month I’ll be commemorating 20 years working with Kim and Chris and I continue to be challenged by the dynamic, fluid nature of this industry,” says David, who lives in Perth’s scenic Swan Valley region. “You never quite know what the next days is going to bring.”

Despite the routine activities that come with ongoing jobs, David says things can change in an instant.

“You can often be one phone call away from a job that can keep you busy for 18 months,” he explains. “With turnarounds and trade ons we’re dealing with live businesses where, unlike some areas of accounting where you’re looking back, with insolvency you’re really living in the present.”

Dealing with distressed people “in the majority of cases” adds to the unpredictable nature of a role that sees insolvency practitioners consistently in the middle of potential conflict.

“You’re often working with agitated people who are under financial and emotional distress – people who are involved with the companies or themselves personally – and that often leads to other issues,” says David. “Then you have the creditors on the other side who are in a similar position, where they are owed money and are also under distress.”

The landmark year that introduced an alternative to Liquidation

When Voluntary Administration was introduced into the Corporations Law by the Corporate Law Reform Act 1992 (Cth) – which came into effect in 1993 – a key objective was to abolish what was perceived to be avoidable involvement of the Federal Court in official management and “maximises the chances of the company, or as much as possible of its business, continuing in existence.”

Prior to the Act, there was principally only Receiverships which banks initiated, and Liquidation. And as David explains, directors were notorious for their reluctance in ceding control and reaching out for financial support while there was still time to turn things around.

“Whether they’ve founded the company, purchased or inherited it, directors are often very reluctant to hand over a certain level of control,” he says. “They’ve got to come to that point where they realise they need help.”

Voluntary Administration was brought in to provide relief for directors of troubled companies and prevent them from incurring further offences under the Corporations Act – and hopefully come out the other side still trading. It also provided a marketing angle for insolvency practitioners.

“I think it was a selling point back then, in that you could say to people, you don’t have to go into Liquidation because you now have this option,” he says. “And the whole idea of VA was to encourage people to put their hand up earlier, which they did.

“That said, I still don’t think directors are doing it early enough because we’re still seeing the ATO taking widespread action. People will often go down to the wire before they realise they need to do something.”

Regional relationships key to WAIS’ enduring success

Today, the WAIS team, which comprises four Partners, experienced Principals/Managers/Business Directors and other professional/support staff, handle 200 files which cover the whole gamut of Insolvency, Bankruptcy and Administrations. And while its head office is based in Perth, the team has a strong presence in a number of regional communities including Busselton, Kalgoorlie, Bunbury, Albany and Esperance. This in turn provides specialist support to communities in Geraldton, Karratha, Port Hedland and Broome. In fact, David believes WAIS’s long-term commitment to regional and rural areas has been key to its enduring success.

“Some years ago, when many firms were focused on the metro area, or had most of their work coming from the banks through Receiverships, work dried up,” says David. “However, the contacts we had with the accountants and solicitors in the major regional areas really appreciated we would go down there and meet with them on a regular basis. That helped cement some strong relationships which continue to this day.”