If you have noticed an increase in the ATO’s enforcement activity in recent months, then this communication will not come as a surprise. In this Alert we discuss how our recent dealings, along with our analysis of the ATO’s enforcement behaviour, has identified a significant increase in the ATO’s enforcement activity when dealing with tardy taxpayers.

It seems that the ATO are sending a clear message that they will increase their activities to identify and recover unpaid taxes, improve their internal systems to capture more information on the taxpayer and initiate enforcement activities at an earlier stage.

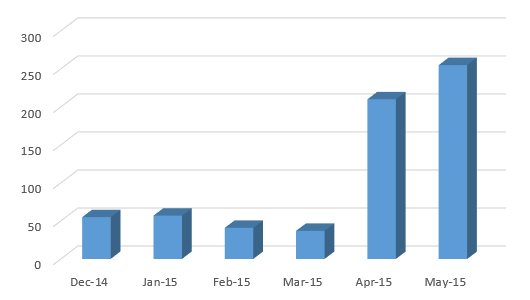

As an example, Figure 1 below shows the increase in the ATO initiated winding up applications during the last six (6) months through the Federal Court of Australia:

We have also seen an increase in the use of the ATO’s other powers to recover outstanding amounts, which include:

- Garnishee notices; and

- Director’s penalty notices.

Some other trends that we have identified are:

- With the increased corporate winding up applications, the ATO have been reluctant to consent to an adjournment of the winding up proceedings, to provide the taxpayer with further time to get their affairs in order;

- When discussing a payment arrangement for a corporate entity, the ATO have recently started referencing a director’s personal compliance history where previously the affairs were considered independently;

- The utilisation of grouping provisions when undertaking legal enforcement.

All of the above activity is consistent with comments made by the Commissioner recently when presenting to the Tax Institute’s 30th National Convention. During this speech, which is available online (www.ato.gov.au), Commissioner Jordan discussed the shift in the ATO’s approach to Debt Management i.e. collecting unpaid taxes – calculated by the ATO at $19.5 billion in 2013/14 (up from $14.5 billion in 2009/10).

The Commissioner advised that the ATO’s new approach includes:

- A more flexible and tailored approach to payment arrangements;

- Earlier intervention to prevent the escalation of debts;

- A focus on a business’s viability;

- Legal enforcement at an earlier stage – with the Commissioner offering an example by way of average debt at legal enforcement for both bankruptcy proceedings and corporate winding up proceedings.

-

ATO initiated

(average debt)Other creditor initiated

(average debt)Bankruptcy proceedings $300,000 $35,000 Corporate winding up proceedings $340,000 $93,000

- Updated communication techniques – including simpler letters and utilising electronic communication techniques, including email, SMS and myGov channels.

The reasons that lead to a strained relationship with the ATO are rarely straightforward and may include procedural complexity, economic conditions, extraordinary events or a simple inability to get a “straight” answer.

When the relationship becomes strained our expert team are available to assist with unravelling the complexity of the situation in order to provide insight into the various options available to solve these types of problems. Please do not hesitate to contact any of our offices to discuss any aspect of the above or a set of specific circumstances.